Real Estate Interests & Ownership

An estate is the degree, quantity, nature, and extent of ownership interest that a person has in real propertly. It refers to one's legal position of ownership, not to the amount of property owned. To be an estate, an interest must be posessory or potentially possessory, with the ownership being measured in terms of duration.

- The "degree and quantity" refers to the amount of ownership

- The "nature and extent" refers to the rights of ownership

There are two general classifications of estates:

- Freehold - ownership for an uncertain duration

- Leasehold - where tenants occupy but do not own

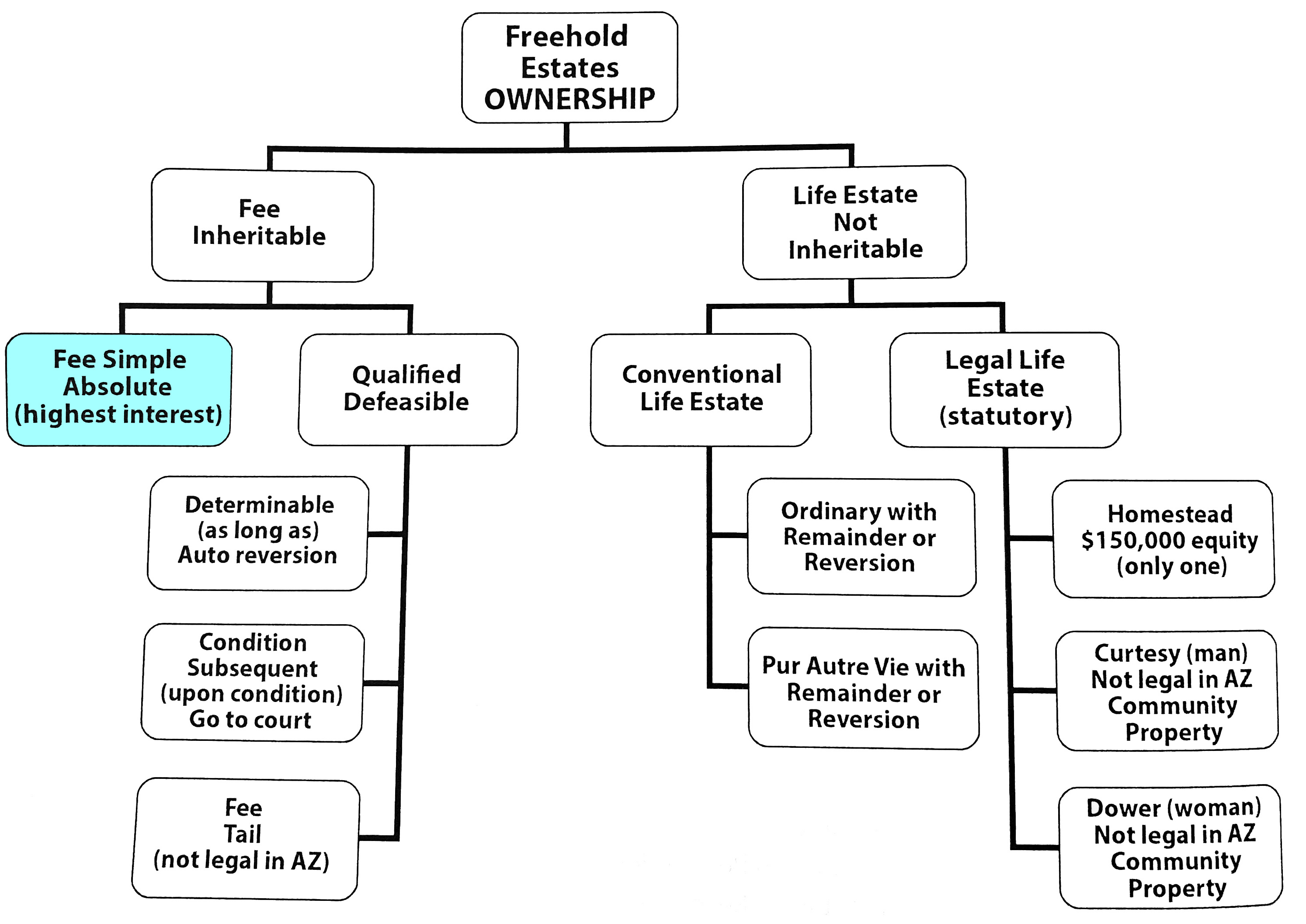

Freehold

The greatest possible interest is a fee simple absolute estate that is fully transferrable and inheritable.

Freehold estates also have two types:

Ownership for an uncertain duration.

Fee Simple Absolute

Absolute ownership, the highest type of ownership.

Qualified Defeasible- 3 types:

- Fee simple determinable - subject to certain restrictions (positive statements)

- Fee simple conditional - subject to conditional restrictions (negative statements)

- Fee tail - subject to restrictions as to right of inheritance and not legal in Arizona

- Ordinary aka Conventional Life Estates - fee simple estates granted to a life tenant for the life of an individual known as the measuring life, who may be the life tenant or another person (pur autre vie). The estate is terminated upon the death of the measuring life.

3 types

- Estate in reversion

- life tenant dies, back to giver - Estate in remainder

- life tenant dies, goes to someone else - Estate pur autre vie

- someone else dies, estate ends

- Estate in reversion

- Statutory (legal) Life Estates - subject to conditional restrictions (negative statements)

- Fee tail - subject to restrictions as to right of inheritance and not legal in Arizona

- Transfer of possession is by a lease

- Transfer of ownership is by a deed

Rent is the consideration paid for the use and possession of the property and is paid in advance.

Leasehold Estates

Leasehold estates are also called less-than-freehold estates and are considered interests in real estate because they give some rights to the tenant while the owner retains some rights (chattel real). Chattel real is an interest in land less than freehold, such as a lease. Leasehold estates are for a limited duraction. The tenant possesses a leasehold estate and the landlord posesses a reversionary fee estate.- Lasts for an indeterminable length of time

- May be passed on to the owner's heirs

- Seller / Giver of interest: Grantor

- Buyer / Receiver of interest: Grantee

- In tenant/landlord relationship: they are the "Lessor"

- Deed: Transfers ownership

- Lasts for a determinable length of time

- Cannot be passed to heirs. Only allows possession

- In tenant/landlord relationship: they are the "Lessee"

Types of Leasehold Estates

- Estate for years Any leasehold estate for a fixed time period. In spite of the name, the term does not have to be a period of years. The tenancy may last 10 days, 10 months, or 10 years. Any fixed period with a specific beginning and ending time. No notice is required to terminate.

- Periodic tenancy A leasehold estate for a duration of time, not a specific date. Continues from period to period until the landlor or tenant gives the other party notice of termination like month to month.

- Estate at Will A leasehold estate with no specified termination date or period of time. Either party can end it at any time. An estate at will cannot be assigned to someone else and it will automatically end upon the death of either the landlor or tenant.

- Estate at Sufferance Runs until the landlord takes action. Describes the possession of property by a holdover tenant. A holdover tenant is someone who came into possession of the property under a valid lease but stays on after the lease expires, WITHOUT THE LANDLORDS PERMISSION.

Types of Leases

- Gross Lease (straight lease, flat lease) The most common lease for residential properties. The tenant pays a set amount of rent each month, and the landlord pays all the building expenses.

- EXAMPLE:

Owner enters into gross lease with tenant for $1,875 per month. Tenant will be responsible for the property insurance, property taxes, building repairs, and pool maintenance. - Net Lease Most common for commercial property. The tenant pays a set amount of rent plus some or all of the building expenses (taxes, insurance, maintenance, etc). The lease can be net, net-net, or net-net-net. The more "nets," the more expenses paid by the tenant.

- EXAMPLE:

Business enteres into a net-net-net lease with XYZ Company for office space. Tenant will pay $3,875 per month. Additinoally, tenant will pay their share of the property taxes, insurance, and building maintenance. Their share is based on the percentage of square feet they are leasing in the campus.

Ownership

There are 2 basic types of ownership of real property:Ownership by a single individual or corporation. One person's interests are severed (cut) from the interests of all others. It is the easiest type of ownership to convey. Government-owned property is also vested in severalty.

Co-ownership between individuals is any form of ownership in which two or more people share title to real property. AKA co-tenancy or concurrent ownership. Undivided interest gives each co-owner the right of possession to the whole property, not just a fraction of it.

Types of Concurrent Ownership

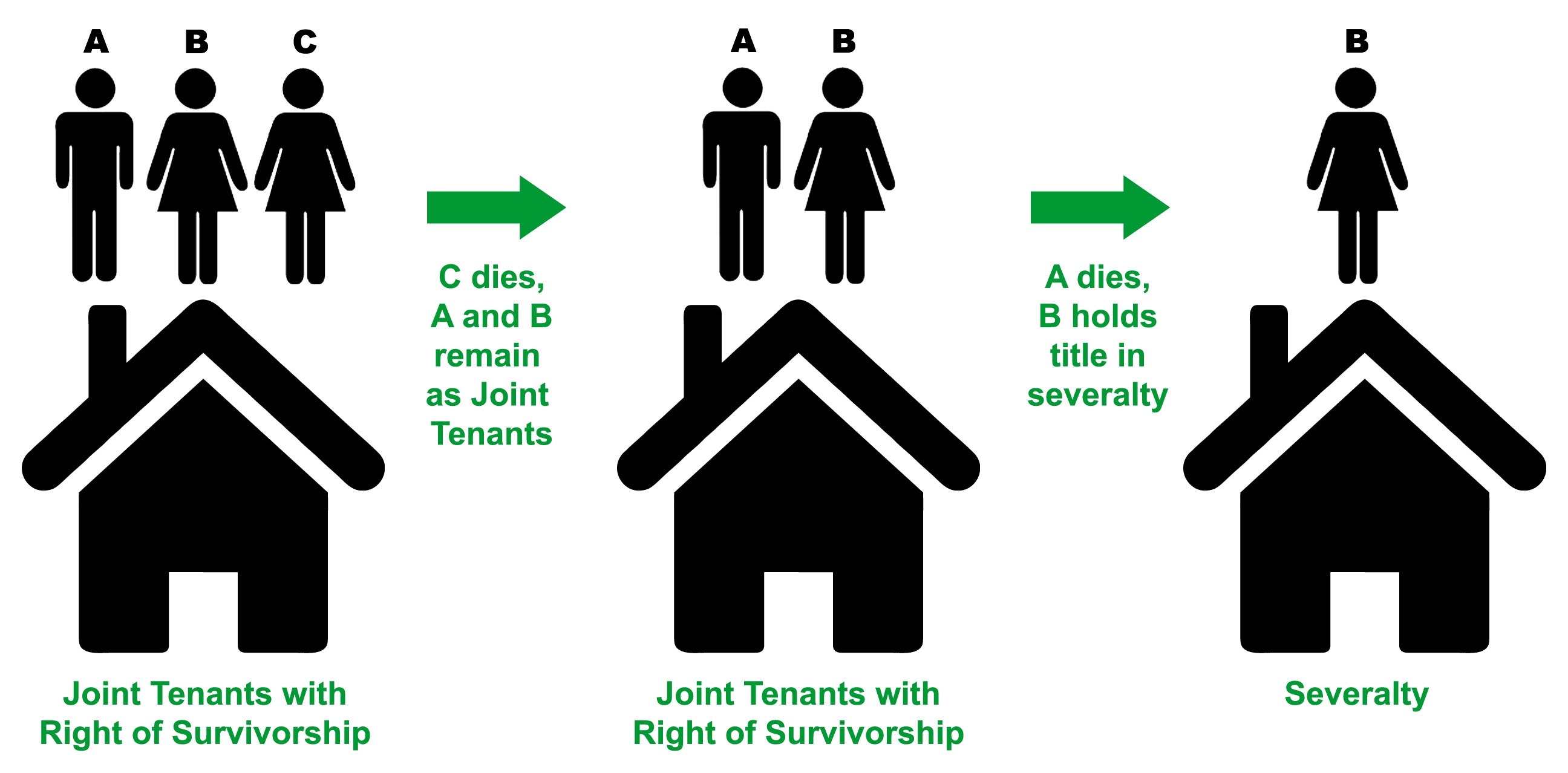

There are different types of concurrent ownership:Joint Tenancy (with Right of Survivorship)

An estate resulting by purchase or grant of two or more natural persons. Often called a poor man's will because from the very beginning it is underestood that as each co-owner dies, their portion of the interest will go to or be inherited by the remaining co-owners, without probate, until the last survivor owns the entire parcel in severalty.

Co-ownership cannot be willed to heirs but it can be sold. The new co-owner would be entering as a tenant in common since they do not meet the "Unity of Time" requirement.

Requirements of Joint Tenancy

Requirements of Joint Tenancy

- Unity of Time. Ownership for all was created at the same time. Nobody can be added afterward.

- Unity of Title. Signifies that the joint tenants hold their property by one and the same deed.

- Unity of Interest. Each owner has equal interest. No one can have a greater interest in the property than the others.

- Unity of Possession. All co-owners share undivided possession. Nobody can claim to own specific parts of the property exclusively.

Key Points- Parties need not be married. May be more than 2 joint tenants.

- Each joint tenant holds an equal and undivided interests in the estate, unity of interest.

- One joint tenant can partition the property by selling his/her joint interest.

- Requires signatures of all joint tenants to convey or encumber the whole.

- Estate passes to surviving joint tenants automatically without probate

- No court action required to clear title upon death of joint tenant(s).

- Deceased tenant's shre is entitled to a stepped-up tax basis as of the date of death.

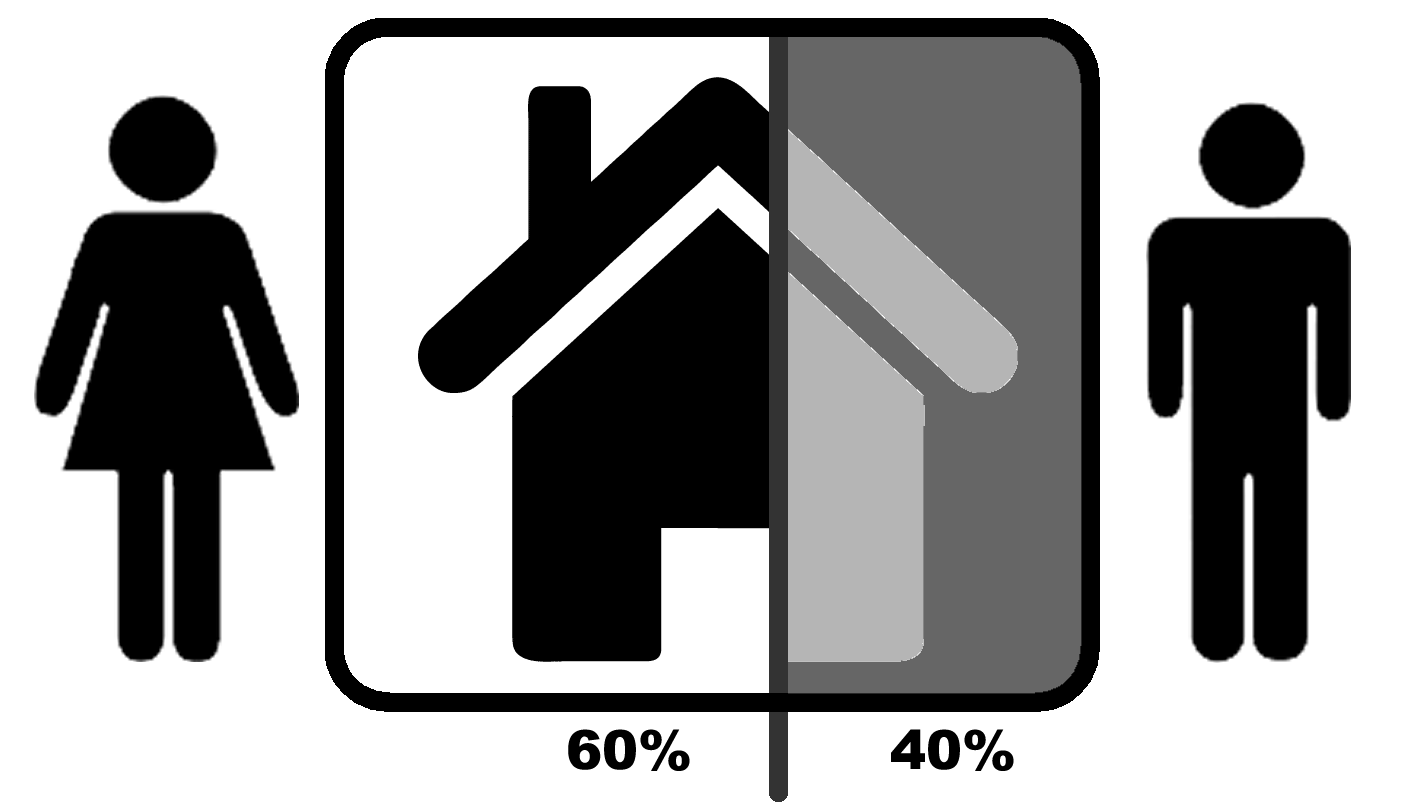

Tenancy in Common

This is the default model of ownership in Arizona

Ownership of realty by two or more persons with each having an undivided interest in the entire property but no right of survivorship. Ownership can be willed to heirs or sold. If two single people do not state how they wish to take title, they will automatically become tenants in common. No special words or terms are necessary to create tenancy in common and it is the only co-ownership model where ownership can be unequal. The deed must show the fractional interest of the parties.

Key Points

Key Points

- Parties need not be married. May be more than 2 joint tenants.

- Each joint tenant holds an undivided fractional interests in the estate, could be owned unevently.

- Each tenant can be conveyed, mortgaged, or devised to a third party.

- Requires signatures of all joint tenants to convey or encumber the whole.

- Upon death, tenant's share passes to heirs by will or intestate.

- Upon death, estate of the decedant must be cleared through probate, affidavit, or adjudication.

- Each share has it's own tax basis.

Community Property

A type of ownership for spouses. Arizona is one of only a few states that have enacted community property laws. Community property is based on the theory that married couples are equal partners, each owning half. This is different than the couple becoming legally combined into one entity. In Arizona, all property acquired by either spouse during the marriage - except acquired by gift, devise, or descent - is community property. Separate property brought into the marriage remains separate property provided it is not commingled with community property. The same is true of inheritance or gifts received after the couple is married. They must be kept separate, or they will become community property.

No right of survivorship in Community Property. If title is taken as community property, each spouse has the right to will their half without the knowledge or consent of the other spouse. Upon the death of either spouse, the surviving spouse continues to own their half. The decased spouse's half will be disbursed according to their will or by the laws of descent.

Key Points- Requires valid marriage between two persons.

- Each spouse holds an undivided one-half interest in the estate.

- One spouse cannot partition the property by selling his/her interest.

- Requires signatures of all joint tenants to convey or encumber.

- Each spouse can devise (will) one-half of the community property

- Upon death, estate of the decedant must be cleared through probate, affidavit, or adjudication.

- Both halves of the community property are entitled to a stepped-up tax basis as of the date of death.

Community Property with Right of Survivorship

A type of ownership only for spouses. Upon the death of one spouse, the property automatically transfers to the surviving spouse, thereby avoiding probate. Community property with right of survivorship may have tax advantages.

A married couple may acquire real property separately using a disclaimer deed. The non-owning spouse signs and records a disclaimer deed avowing that they have no interest and will never claim an interest in the property. Once the disclaimer deed is recorded, notice is given that the community property estate of this married couple is broken on this property only. Without a recorded disclaimer deed, both spouses could have a community property interest from the time the property was acquired.

Key Points- Requires valid marriage between two persons.

- Each spouse holds an undivided one-half interest in the estate.

- One spouse cannot partition the property by selling his/her interest.

- Requires signatures of all joint tenants to convey or encumber.

- Each spouse can devise (will) one-half of the community property

- Upon death, estate of the decedant must be cleared through probate, affidavit, or adjudication.

- Both halves of the community property are entitled to a stepped-up tax basis as of the date of death.

Tenancy by the Entirety

Type of ownership that does NOT exist in Arizona because of Arizona's community property laws. Tenancy by the entirety is only for spouses and regards them together as one single legal person. Community property views spouses as equal partners and these types of tenancy directly conflict.

Vocabulary

Chattel Real- An interest, such as a leasehold, in an item of immoveable property, such as land or a building.

Curtesy- Fractional interest of a husband in the estate of his wife at the time of her death. Illegal in Arizona

Demise- The transfer of an estate to another for years, for life, at will, or by lease..

Grantee- A person receiving a grant of real property.

Grantor- A person transferring title to real property.

Holdover Tenant- Someone who remains in the property after the lease has expired.

Homestead- Primary residence, the equity in which is usually exempt from attachment by creditors to a statutorily preset amount.

Inchoate- Incomplete, as an interest in property, such as a lien that has been filed but not enforced.

Lessee- The tenant in a lease agreement.

Lessor- The landlord in a lease agreement.

Probate-The judicial process of determining who are the rightful heirs.

Remainderman- A third party who has a future interest in property upon the termination of a life estate.

Reversion- The returning of property upon the termination of a life estate and that is held by the Grantor.

Right of Survivorship- The characteristics of a joint tenancy by which the surviving joint tenant automatically takes title upon a joint tenant's death.

Waste- Reduction of value caused by destruction, damage of property by someone in possession who holds less than a fee estate.

Leasehold Estate- Allows holder of the lease to have the right of possession. Contract for possession is called a Lease. Under Statue of Frauds, leases for more than one year must be in writing to be enforceable.

Estate for Years- Lease that extends for a definite term. No notice is required to terminate this estate. Death by either party or sale of the property will not terminate this estate.

Periodic Estate- No definite term and renews automatically for subsequent units of time. Notice is required to terminate this estate. Death of either party or sale of the property will not terminate this estate.

Estate at Will- Created when the owner permits another to occupy the property without a formal agreement. Death of either party and sale of the property will terminate this estate.

Estate at Sufferance- Lowest type of leasehold estate. Holder of estate is also called a 'holdover tenant'. The tenant is trespassing and the landlord can evict the tenant or accept the rent, which changes it to a periodic estate.

Gross Leaes- Flat lease payment from tenant to landlord. Landlord covers building expenses.

Net Lease- Lease where tenant pays a base rent and shares buildings expenses with landlord.

Ground Lease- A long-term lease for the use of the land.

Ownership in Severalty- Individual ownership by a single individual or corporation. Government owned property is vested in severalty. Owner can will property to heirs.

Chapters

- 1. Property Rights: Private and Governmental

- 2. Real Estate Interests & Ownership

- 3. Transfer of title & Title Insurance

- 4. Encumbrances

- 5. Foreclosure, Carryback Docs & Financing

- 6. Real Estate Investment & Taxation

- 7. Residental Financing

- 8. Math & Equal Opportunity

- 9. AZ Landlord and Tenant Act & Property Management

- 10. Rules & Regulations of the Real Estate Department

- 11. Real Estate Brokerage: Law of Agency & Public Protection

- 12. Contracts

- 13. Listing and Contract Forms & Procedures

- 14. Appraisal

- 15. Legal Land Descriptions

- 16. Escrow & Closing

- 17. Brokerage Practices, Legal Procedures, & Bankruptcy

- 18. Disclosures & Warranties, Land Development & Construction

- 19. Glossary